Introduction

2020 was a challenge for commercial property markets, not just in Australia, but around the globe. Covid-19, through its negative impact on the economy and restriction on people’s movements, hit demand for space, goods and services. But not all property sectors were affected to the same degree. Industrial property stands out as a true survivor, together with parts of the retail sector. Lock downs only further boosted growth in online business, which has been the prime source of demand for industrial space this decade. And investors followed: industrial property became even more attractive than it already was as funds that would otherwise have flown into offices or shopping centres sought home in warehouses. And Brisbane has benefited from this trend with its continuous growth story.

The Queensland Economy – State of Play and Outlook

Covid-19 has been the dominant theme since early 2020. It sent the global economy into a sharp tailspin, from which it is gradually recovering. Australia did better than most economies due to its success at controlling infection numbers and swift government financial support. However, it did come at a cost to the economy. Most notably the closure of international borders will be felt for years to come.

Queensland did remarkably well within the national context. At the time Covid arrived, the state economy was in the early stages of recovery after a bust in Brisbane’s apartment construction boom and work had started on big-ticket infrastructure project such as Cross-River Rail. The swift closure of the state’s borders limited the virus’s spread which in turn allowed much of the state economy to function normally. On the other hand, Queensland’s tourism and hospitality industries, some of the state’s largest employers, were hit hard.

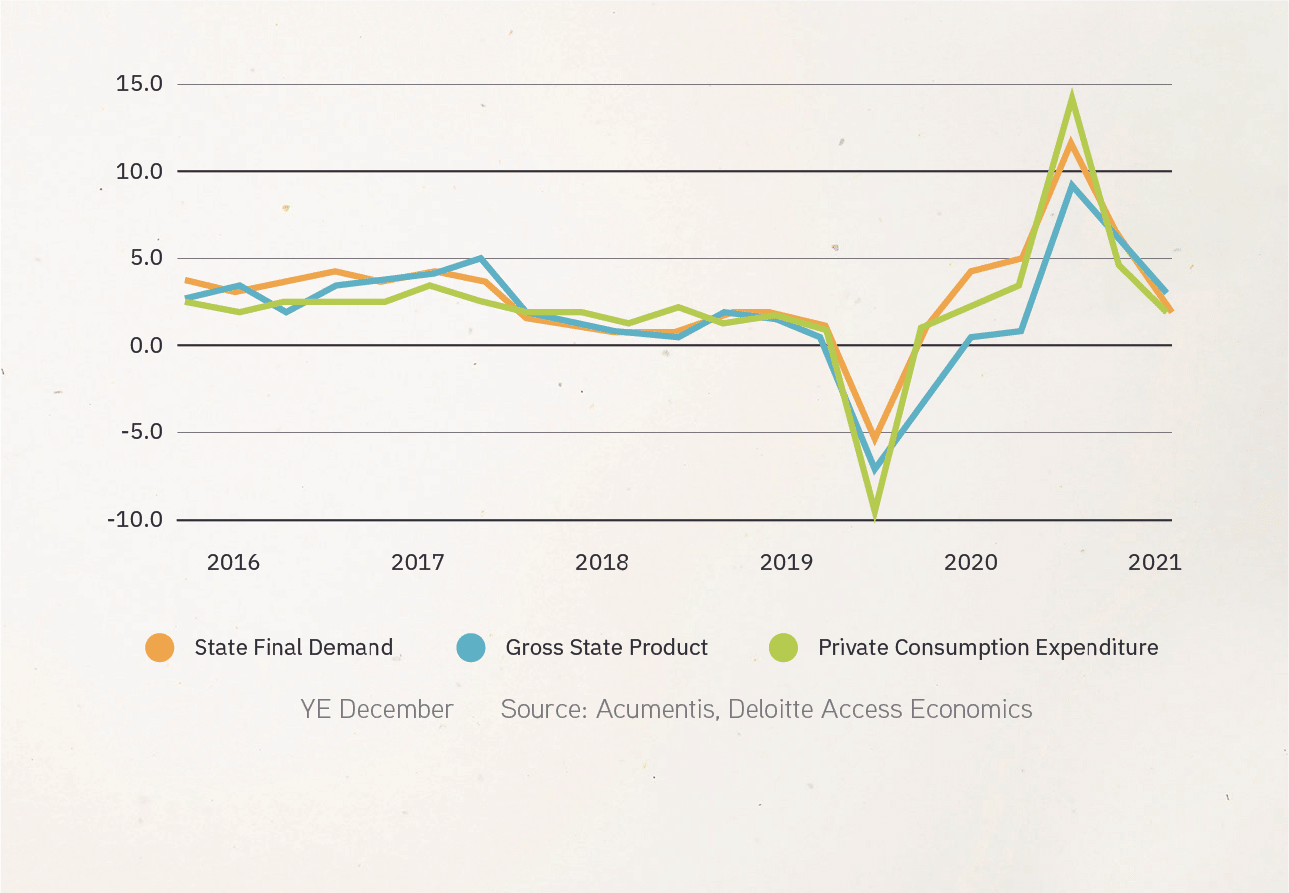

State Final Demand (SFD) was slashed by 6.1% in the June quarter but bounced straight back in the September quarter. It was helped by the federal Job Keeper and Job Seeker allowances, which cushioned the impact on unemployment, kept businesses afloat and upheld, even boosted, private consumption expenditure. While the rate of growth slowed through the December quarter of 2020, the state’s economy managed to grow at a faster rate through Covid-affected 2020 than ‘normal’ 2019.

Figure 1. The Queensland Economy

However, according to Deloitte Access Economics growth through calendar 2021 is set to be much more modest. The most immediate challenge is the phasing out of the Job Keeper and Job Seeker supplements as the federal stimulus packages are wound back. Less money in the pocket, an increase in unemployment and the possibility of business closures will weigh on private consumption expenditure and investment. Uncertainty over the vaccine rollout means the lifting of international travel restrictions has been pushed back and is not likely to recommence until late 2021 or even 2022. Moreover, travel restrictions have also cut population growth. Up to two years of migrants will be permanently missing from pre-Covid projections, with implications for sectors such as residential construction, hospitality and retail.

Nonetheless, the forecasters’ outlook is for SFD growth to pick up significantly through from late 2021/early 2022. The return of international tourists, restarting population growth, positive net interstate migration, monetary policy that remains highly stimulatory and an increase in investment should underwrite a solid upswing in the Queensland economy from 2022.

Demand for Industrial Space

State of Play

At the time Covid-19 arrived, occupier demand for industrial space in Brisbane was strong. The Queensland economy was recovering from a bust in the inner Brisbane residential construction cycle and gas exports dropping out as a growth driver. The improvement was underpinned by solid population growth and the ramping up of investment, both private and public.

Occupier demand was boosted by global trends in logistics and online retailing, with operators requiring ever larger, more technologically advanced premises to handle massive growth in trading volumes. As such, demand for new properties is largely isolated from the ups and downs in the business cycle.

With growth in SFD falling sharply in Q2 in response to Covid, underlying (occupier) demand for industrial space was also hit hard. The sudden rise in uncertainty caused industrial space users - both tenants and owner/occupiers - to delay leasing decisions. However, this primarily affected market ‘churn’, or take-up, rather than net absorption. Actual demand was held up by deals struck prior to Q2. Since then, the market has become much more fluid and is approaching pre-Covid levels of leasing activity.

Demand has been highly skewed towards warehouses and distribution centres as a consequence. Factory demand makes up no more than 20% of the total most years, dominated by food processing and building/construction materials manufacturing.

In terms of location, demand tends to follow supply. With inner ring estates largely built out, new demand has focused on the Southwest and Southern Corridors, where developers have concentrated their activity. Other populate locations are the Trade Coast (ATC) and, in the Northern region, Brendale.

Outlook

The short term outlook is for modest market-wide demand. However, there are still some uncertainties and there will be differentiation between types of space users. Weak underlying demand this year will affect businesses already struggling with the effects of Covid. Others, such as online/e-commerce and supply chain operators should do much better. An open question is the rebuilding of supply chains, which were severely disrupted during the early phases of Covid – particularly as it affected China. The result has been a change from ‘just in time’ to ‘just in case’, which means manufacturers, distributors and retailers have been trying to secure more stock than they need in the near term in order to catch up on lost trade and to prepare for possible future disruptions.

Supply

State of play

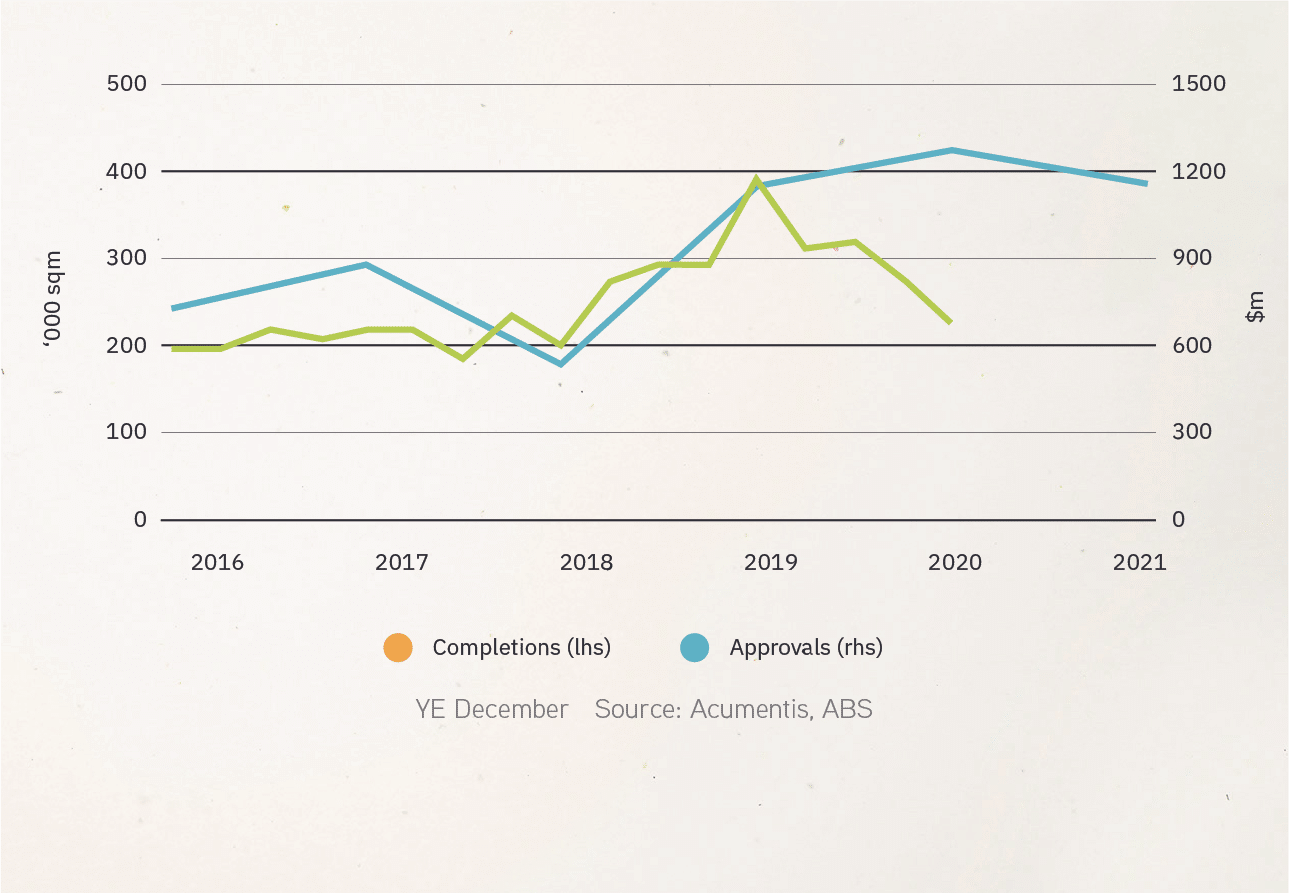

Brisbane’s industrial market size has been growing fast since 2018. Despite Covid, 2020 set a new post-mining boom record for the largest amount of new industrial space added to stock.

Underpinning the continued strength of construction is a mix of demand-side and financial drivers. Structural change in the supply chain industry and rise in e-commerce creates demand for new, highly specified premises located near major road, rail and port infrastructure. More often than not, the new properties are larger than before to achieve economies of scale and increase velocity/throughput. Whilst economic growth is also an important variable in this type of property demand, the latter is less sensitive to cyclical swings in the economy. Affordable rents are encouraging tenants to move to new premises. Face rents have barely moved since 2007/08. In inflation adjusted terms, average industrial rents in Brisbane are between half and one third of those of the 1980s. Upgrading decisions are further encouraged by the difference between market rents and what a tenant would be paying towards the end of a 10-year lease with fixed annual increases. Only the cost of relocation and new fitouts prevent more tenants from moving, although a steady rise in leasing incentives offered by (mainly institutional owners) can partially offset that.

Figure 2. Supply of New Industrial Space, Brisbane Industrial Market

The lack of rental growth would traditionally make industrial development unfeasible. However, consistent falls in interest rates and associated tightening of investment yields means developers are able to sell their products for higher prices. Meanwhile, demand from the investment market - including the funds management arms of institutional developers - encourages speculative construction. The target is tenants that are too small, or unwilling, to pre-commit. With take-out a near certainty once a tenant is secured, speculative construction faces few hurdles.

Historically low interest rates and strong (recent) capital gain continue to encourage owner-occupation. For many industrial space users, the cost of ownership is lower than a long lease for, with the benefit of owning an (appreciating) asset.

Outlook

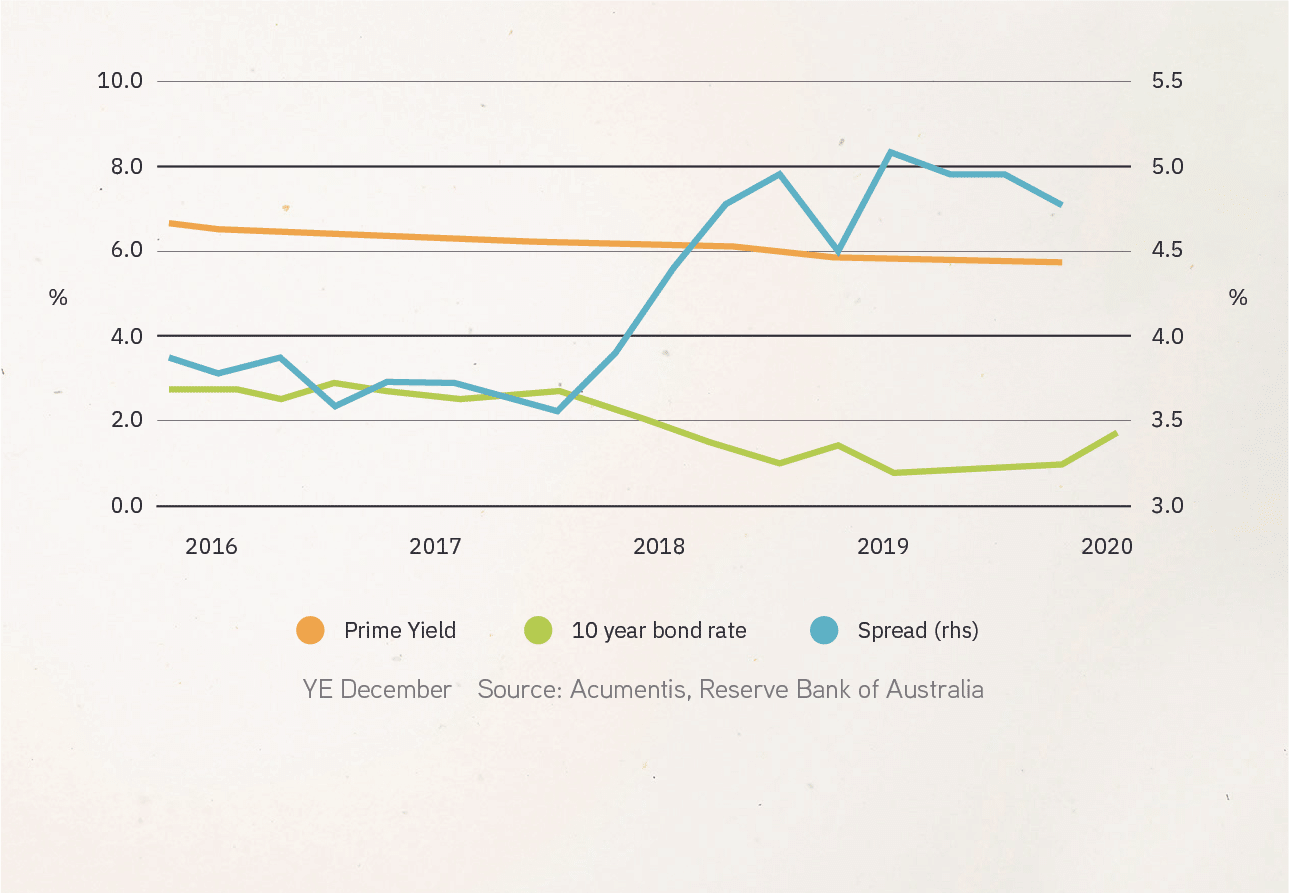

The short-term outlook for construction is for more of the same. Reserve banks around the world are likely to stick to historically low interest rates to boost economic growth. And, while recent ructions on financial markets, which pushed bond rates higher, have the potential to put pressure on property investment yields, wide spreads between bond rates and hurdle rates provide some room to move.

However, should yields soften they will affect the financial feasibility of construction. Developers will need to charge higher rents or there will be no construction. Depending on how quickly the market accepts higher rents, we may see a slowing in industrial construction, even a pause. However, there will be a lag before construction reacts due to existing commitments. For now, ABS building approvals show a slight downward trend, although that is partially the result of a number of large projects approved within a relatively short time in late 2019/early 2020. Actual new stock in 2021 has the potential to equal, or even exceed, the 2020 total.

Land Values

Affordability and availability of industrial land remains a key ingredient in the continuing expansion of the Brisbane industrial property market.

After peaking during the 2000s mining investment boom, industrial land values halved across the Brisbane market. They remained flat until 2015 and have been increasing ever since, though at varying pace. There was little movement in the first half of 2020 as Covid slowed demand, but growth recommenced in the last quarter.

The steady increase in land values since 2015 mirrored the rise in industrial construction and firming investment yields. It is the result of competition amongst developers needing to re-stock their land banks.

Despite regularly raised concerns that Brisbane was running out of developable land, developers managed to service sufficient quantities of greenfield land ahead of demand to avoid any shortages. While land may not be available in all of the popular locations, there is unlikely to be any shortfalls in the short to medium term that would cause problems for the Brisbane industrial market.

Rents/Leasing Market

State of Play

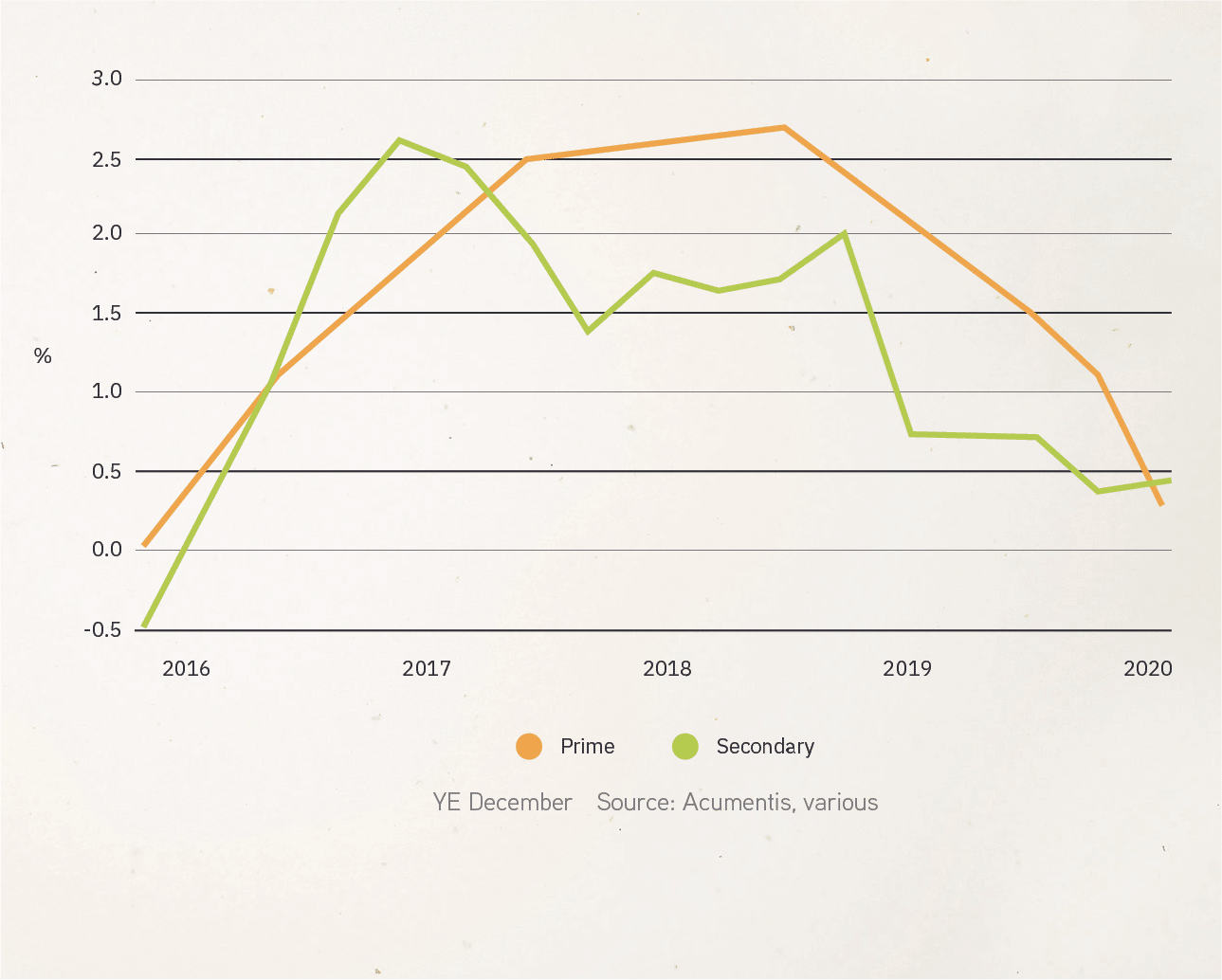

Rental growth has been challenging the past 12 months. In the prime sector, net face rents have been flat over the past four quarters after experiencing modest growth over the previous two years. At the same time, leasing incentives have increased by up to 4% to an average of around 16% across Brisbane’s major industrial regions, causing a decline in effective rents. The reason for the setback is a rise in industrial vacancies caused by the highest level of new stock entering the market since the late 2000s and the impact of Covid-19 on (short-term) leasing demand.

In the secondary market, net face rents declined by 3 to 6% over the same period, although the rise in leasing incentives was more modest at just 1%. Owners of secondary property are typically more flexible when it comes to face rental adjustment compared with their largely institutional counterparts in the prime sector.

Figure 3. Rental Growth, Brisbane Industrial Region (Average of Sub-Regions)

Brisbane’s industrial regions tend to move in unison when it comes to rental performance. While the average level of rents varies between regions, short term differences in rental growth and leasing incentives tend to reflect individual leasing deals rather than be reflective of a shift in hierarchy.

At the time of writing, average prime industrial face rents ranged from around $105 per square metre in locations such as Yatala, Ipswich and part of the Western Corridor, to a little over $120 at the Trade Coast. Average secondary rents varied from the low to mid $80s to the mid $90s.

Leasing Outlook

Rental growth is expected to remain subdued in the short term. At the institutional end of the market, the inflow of funds continues to underwrite development of new premises, which in turn underpins competition for tenants. Construction is a mix of pre-leased and speculative stock, preventing vacancies from contracting to levels that would stimulate rental growth. As long as yields continue to firm, or the spread over bond rates drops below acceptable levels, development will stack up.

Large tenants will continue to benefit from willing developers, able to negotiate long leases at highly competitive rents, with modest annual reviews and incentives that cover at least part of variations (from standard designs) and fitouts. Medium-sized tenants will also be able to take advantage of generic speculative development, though there are fewer options for smaller users.

The secondary market will take its cue from its prime counterpart. As long as sufficient prime space remains available to satisfy tenant demand, there will be little pressure on rental growth. An exception are traditional locations with little vacancy, no vacant land and pressure from conversion to higher land uses, i.e. office and residential. That includes also includes occupiers who are bound to a particular location.

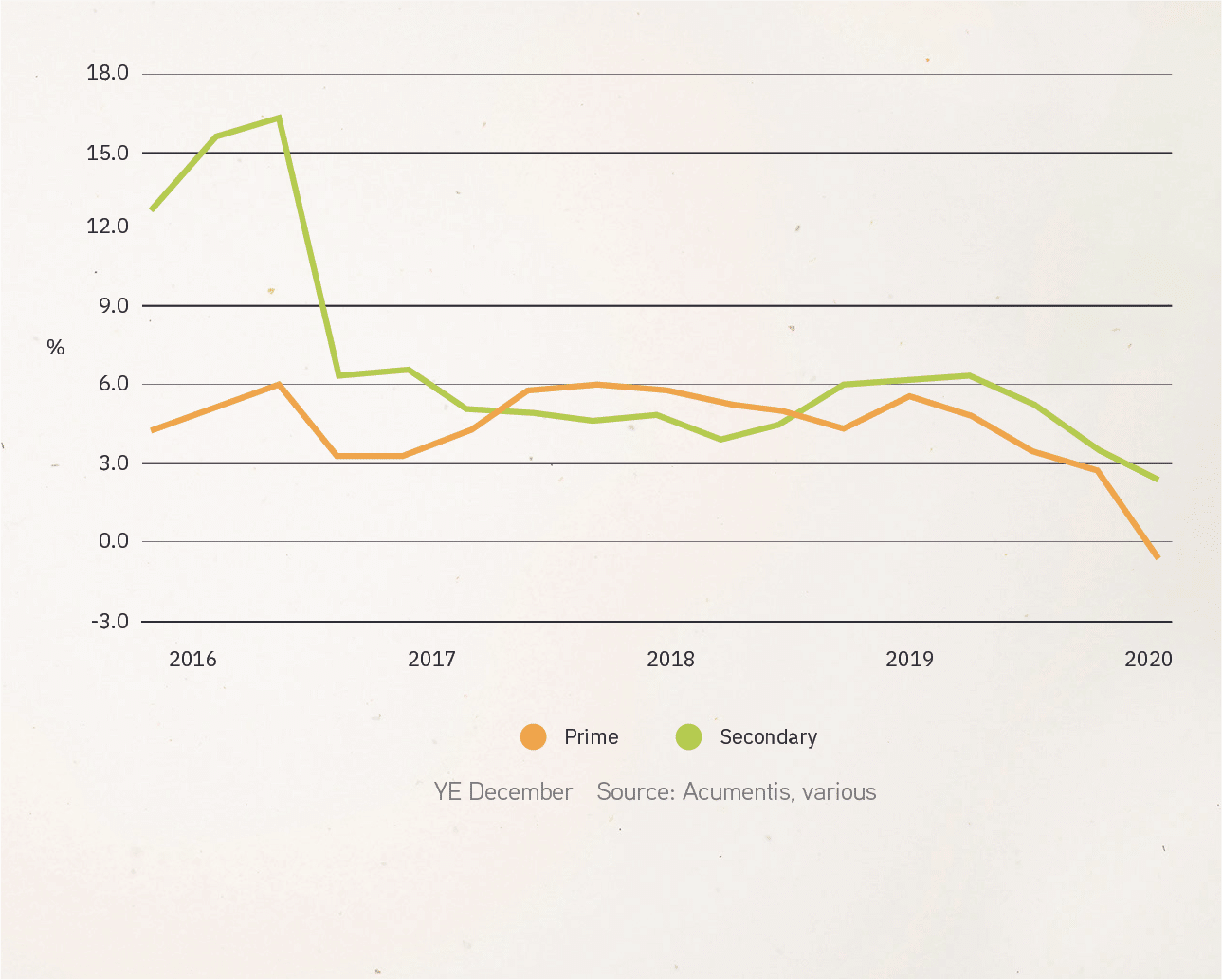

Investment Market

Industrial property has been a solid performer over the past 5 years. Growth in capital values peaked in 2017, then hovered between 4 and 6% pa until 2019.

Figure 4. Capital Value Growth, Brisbane Industrial Region (Average of Sub-Regions)

During the first half of 2020, the Covid pandemic caused a sharp increase in uncertainty that took its toll on transaction activity in the non-residential property sector. Concerns started to ease in the second half, with the market becoming more active. However, not all property classes were affected to the same extent. Industrial property stood out as the best performer, while the office and parts of the retail sectors struggled. Indeed, the total value of industrial property traded in 2020 exceeded the 2019 figure by over 14% nationally. In contrast, activity in Brisbane declined by a quarter to around $1.4 billion, but only because it followed a record-setting $2 billion worth of transactions in 2019. Activity was weak until September but picked up strongly in Q4. The latest data suggests that the momentum has carried through into 2021.

Industrial property remains highly sought after at all levels of the market. With prime stock is short supply, institutions have been looking at alternatives for growth such as fund-through development and secondary properties in established locations that offer development opportunities in addition to greenfield development.

At the other end of the market, confidence has returned to privates and small syndicators. Activity picked up strongly in September and October last year and has continued into the new year. Brisbane remains a highly sought-after market for private investors and syndicators from Sydney and Melbourne who see better value for money in Queensland.

| Price bracket ($m) | Building size (sqm) | Price range ($/sqm) | Median price ($/sqm) |

|---|---|---|---|

| > 0.5 | 116 to 252 | 1,674 to 3,063 | 1,925 |

| 0.5 to 1.5 | 225 to 556 | 1,250 to 3,788 | 2,060 |

| 1.5 to 5 | 644 to 3,330 | 1,186 to 4,583 | 1,854 |

| 5 to 15 | 2,387 to 10,800 | 1,598 to 2,543 | 1,926 |

Figure 5. Industrial Property Sales, Brisbane, September 2020 to March 2021. Source: Corelogic

Demand from owner-occupiers also remains solid. The current environment of very low interest rates continues to make ownership an attractive proposition for industrial space users. Not only can ownership be cheaper than leasing, but property owners have benefited from price rises/firming yields over the past years.

The strength of investor demand saw yields firm by 10 to 15 basis points at the (super) prime end of the market over the 12 months to December 2020. While high 4%s are still rare in Brisbane, low 5%s are now common. However, average prime yields are closer to the low 6%s. Heightened leasing risk has seen average yields on secondary properties either stagnate or even soften a little at the upper end since the start of 2020.

Outlook

The key for the industrial investment markets remains the global outlook for interest rates. According to Deloitte Access Economics, reserve banks will keep policy rates at historically low levels in the short to medium term to support recovery from Covid-induced recessions. Recent movements on financial markets reminded players that circumstances can change even again the will of reserve banks, but for now yield-bond spread allow for some adjustment before affecting hurdle rates.

Figure 6. Brisbane Prime Industrial Yield Versus 10-Year Commonwealth Bond Rate

Accordingly, yields are expected to remain firm in the near term, but there will be some differentiation between grades. As a whole, industrial property remains highly attractive for its relatively low risk - at least at the prime end of the market. There is some potential for further yield firming at the top institutional end of the market due to competition for assets, even if bond rates continue to soften. This also includes other properties with (very) long secure cashflow or development potential. However, investment in smaller units and secondary properties is inherently more risky and may not participate in further yield compression. Conversely, investing in your own premises and becoming an owner-occupier remains highly attractive.

Capital values will mirror the movement in yields. There are unlikely to be major increases in the near term given the relatively flat outlook for both rental growth and investment yields. In the design-and-construct market, any increases in construction costs will flow through to higher prices. Similarly, shortages of stock suitable for owner/occupation could also result in rising prices/values.