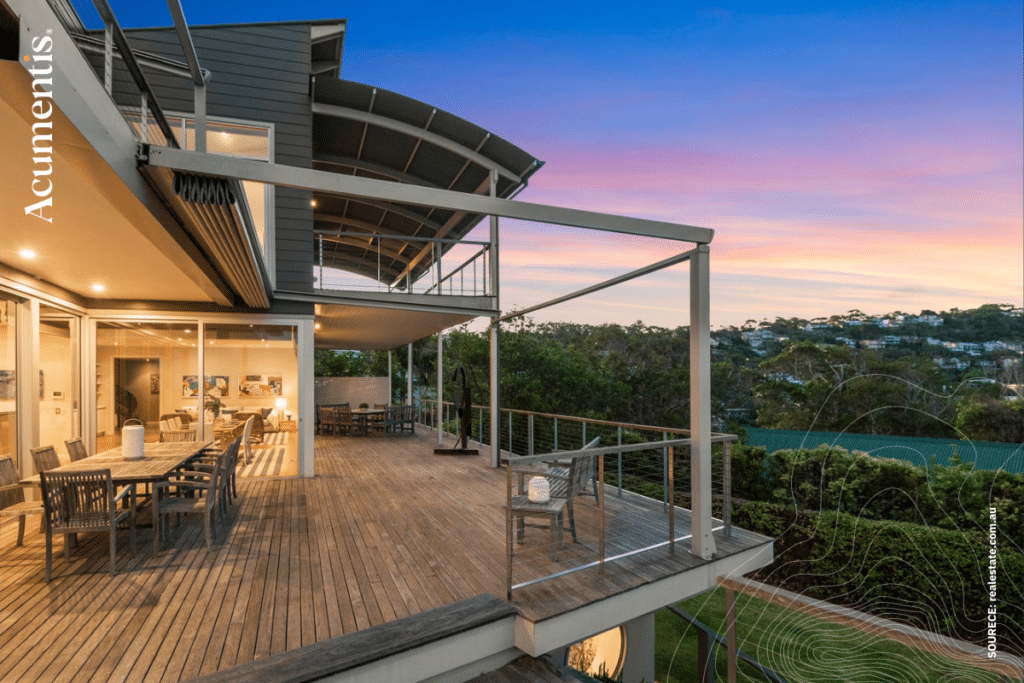

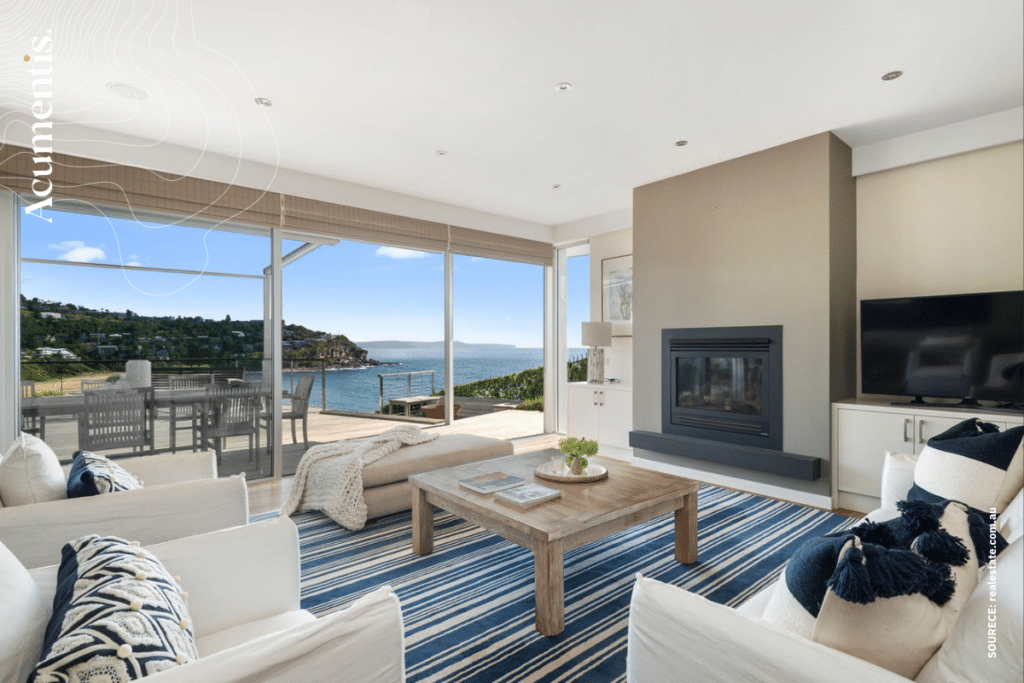

Whilst most people are snuggling up in front of the fireplace to avoid the cold, others are heading for the water. Former AC/DC guitar technician and now billionaire - Richard White, has just set the record price for the Northern Beaches of Sydney with a $27.5M purchase at Palm Beach. When I started my career (last century), Palm Beach was the “millionaires playground”… It’s more like the “billionaires playground” now! I’d still like to know how a guitar tech becomes richer than Angus Young. Anyway, I digress. The property on Pacific Road previously sold in June 2018 for $15M, reflecting an increase of 83.33% in 4 years. The sale breaks the previous record price of $27M of a double block along the beachfront at Iluka Road Palm Beach.

Suburb Records Smashed

In the adjoining suburb of Whale Beach, a new suburb record price was set for the former home of journalist Jana Wendt at a little over $14M. The Malo Road house sits next to Malo Reserve and at the southern end of Whale Beach itself. The sale outdoes the previous long held record price of $13.1M set in 2012.

Further down the coast at Dee Why, another suburb record price for a house was set. An oceanfront at Summit Avenue has sold for almost $10M and eclipses the previous suburb record of $8.05M that was set in June 2021. The sale was “off-market” and reflects a tripling in value for its previous sale of $3.03M in October 2014.

Down at the other end of Sydney in Burraneer, another record price was set at $20M for a direct waterfront property on Woolooware Road. The sale smashes the previous suburb record of $9.1M set in 2020 and the Sutherland Shire record of $16.3M.

A waterfront at Elamang Avenue, Kirribilli recently set the suburb record at a price of $19.1M, well above the auction price guide of $17M. The house originally built in the 1950’s, whilst presenting very well, it is a fairly basic type of property.

At Vaucluse, a property known as Point Seymour, at the end of Fitzwilliam Road is on the market with a price guide of $50M. The 1,271m2 waterfront property with an Art Deco P & O style house would be the record price for 2022 if sold at the asking price or close to it. It has an extensive waterfrontage and quite a landmark property. The property faces due north and is quite distinctive from the water. Definitely a trophy home and it will be interesting to see how the market responds to the price tag.

Global Impacts & the RBA

So whilst the luxury market continues on with suburb record prices, the storm clouds are definitely forming for the rest of the market. There is no doubt economic concerns are a global and local problem; and this will definitely reflect in the property market. The Reserve Bank of Australia (RBA) is now playing catch-up to try and stem inflation. The surprising 0.50% increase to the official cash rate said it all. It spoke volumes about the Reserve Bank having missed the boat. Rather than gradually ratcheting up rates from late 2021, it chose to do nothing until May 2022. For the RBA to raise rates during an election - whilst not unprecedent - it is exceptionally rare. They realized they had missed the starting gun. Now you could be forgiven for thinking hindsight is a wonderful thing Mr Raptis, yes, it is, but go back and read my comments from mid to late 2021 where I kept asking how long before the RBA starts raising rates to quell the property boom.

If you are wondering why inflation has spiralled out of control? Governments all over the world spent too much money in stimulus packages as a result of Covid-19

I suspect the refinance market will be run off its feet as borrowers end fixed rate terms and seek to shop around to try and ease the pain.

It is likely that next month the United States will officially go into recession and that will send the stock market into another head-spin. That announcement won’t be a good sign for the rest of the world. Even China, the world’s largest manufacturer, will be directly affected as world demand eases.

So if you are wondering, why has inflation spiralled out of control? The answer is easy. Governments all over the world spent too much money in stimulus packages as a result of Covid-19. As my old man used to say, “nothing’s for free son…there’s always a price to pay”. Whilst it was appropriate for governments to pump money into the economy in such a global crisis, they simply over did it. The excess stimulus resulted in greater demand which pushed up prices.

I hate to say it, but this tangled web the world is in now with inflation, will not be fixed quickly and unfortunately it will take a recession to sort it out. That said, for those cashed up, a recession is a great opportunity to buy well priced equities and real estate. Sadly, that upswing for some will be at the loss of others.

So, hang onto your seats, as the road is likely to be rocky over the next 18 months or so.